marin county property tax exemptions

The individual districts administer and grant these exemptions. Not yet posted but upcoming soon is information for filing for a low income senior exemption for the new Marin Wildfire Preparedness Authority parcel tax which is assessed on building square footage.

Property Tax Re Assessment Bubbleinfo Com

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

. Qualifying for Senior Exemptions. The individual districts administer and grant these exemptions. This section also provides direct links to downloadable and printable forms to help file your property taxes.

If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption. 32 rows Change of Ownership Statement in Case of Death. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption.

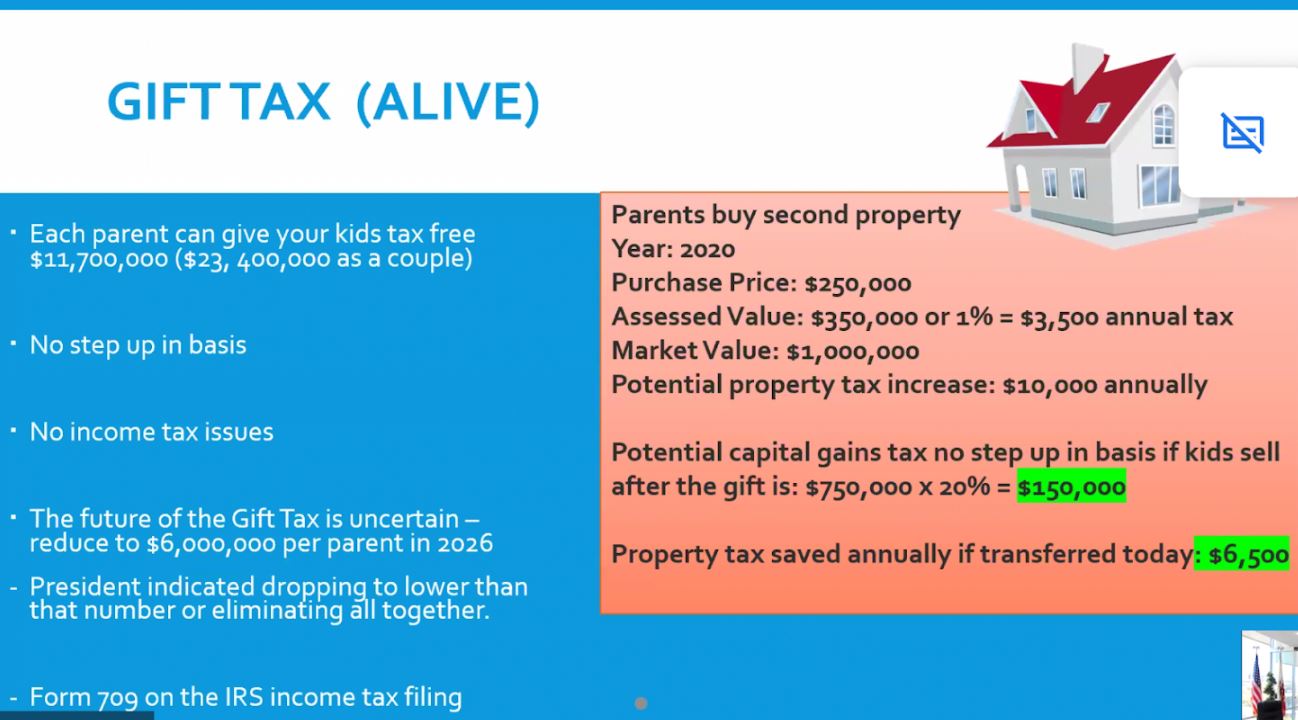

The voters approved this parcel tax in March 2020 by approximately 71 for a period of ten years starting with the 202021 fiscal year. Your property taxes would remain at 3500 instead of the new rate of about 12500 per year for a 1M house. Veterans Exemption Veterans with a 100 disability due to a service-related injury or illness may be eligible to exempt up to 150000 on the assessed value of their home.

Higher for more meaning a fair number of homeowners could. Learn About Your Senior Exemptions. The Measure A parcel tax has a term of 20 years commencing in the 2015-2016 tax year.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad-valorem taxes. The Measure A parcel tax was put before the registered voters of Marin County as a General Election ballot measure on November 4 2014. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes.

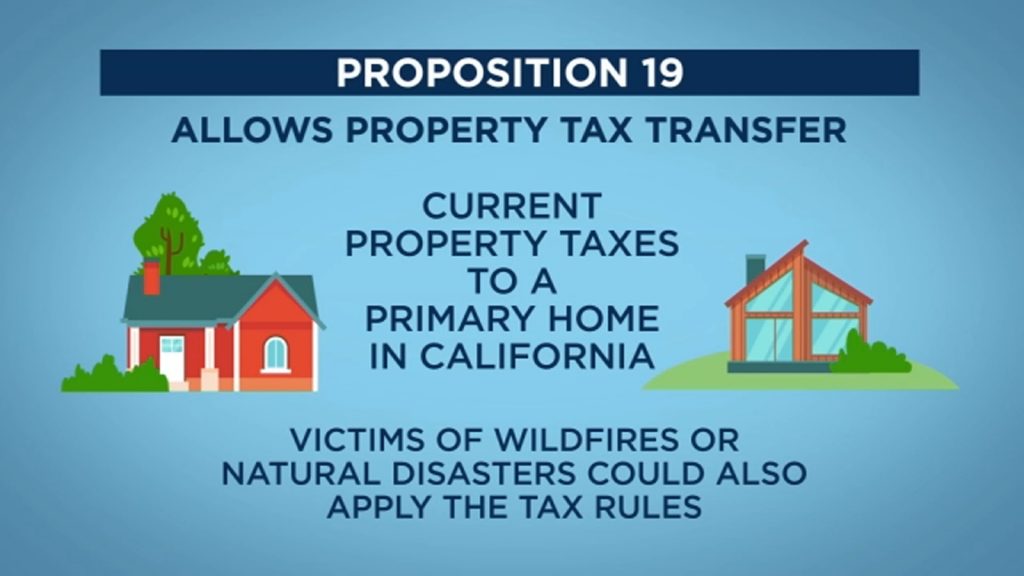

They all are legal governing units managed by elected or appointed officers. Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. Claim for Reassessment Exclusion for Transfer Between Parent and Child.

The Marin Wildfire Prevention Authority Measure C is a special tax charged to all parcels of real property located in Marin County within the defined boundary of the Member Taxing Entities. Requests for accommodations may be made by calling 415 473-3220 VoiceTTY or 711. Claim for Reassessment Exclusion for Transfer Between Grandparent and Grandchild on or After February 16 2021.

The county provides a list of exemptions for property tax items that apply tour property. Exemptions EXPLORE If you are a person with a disability and require an accommodation to participate in a County program service or activity requests may be made by calling 415 473-4381 Voice Dial 711 for CA Relay or by email at least five business days in. The final levy for the Measure A parcel tax will be for the 2034-2035 tax year.

Most school districts and some special districts provide an exemption from parcel taxes for qualified senior citizens. For example the property taxes for the home that you have owned for many years may be 3500 per year. The income threshold is pretty high 97600 for 1 person.

To qualify for a Measure A senior exemption you must be 65 years of age or older by December 31 of the tax year own and occupy your single-family residence located in the Measure A tax zone of the Marin County Free Library District. For more information please visit California State Board of Equalization webpage or this publication. If the application is filed between February 16th and December 10th a partial homeowners exemption 80 will be approved.

To qualify for a senior low-income exemption you must be 65 years or older. The Marin County Assessor co-administers the exemptions with the California State Board of Equalization. Please contact the districts.

Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions. Marin County collects on average 063 of a propertys assessed fair market value as property tax. Taxing units include city county governments and various special districts such as public schools.

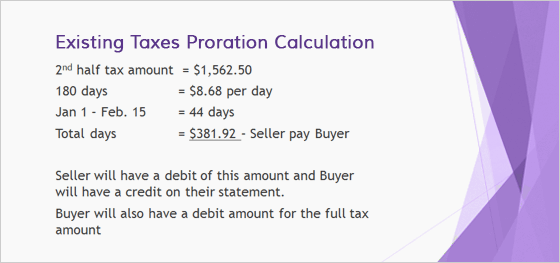

Establishing tax levies estimating property worth and then receiving the tax. Who voted for this parcel tax. To receive the full homeowners exemption the property owner must reside on the property January 1 and file the homeowners exemption claim form with the Marin County Assessors Office by February 15th.

Overall there are three stages to real estate taxation. Certain agencies eg sewer and water send a bill to the property owner or renter directly and offer discounts some of which we describe further down this page. Also you can visit the Marin Countys Assessor and.

Owner must be 65 years old or older by July 1 of any applicable tax year Property must be an owner-occupied single-family residence house condo townhome An exemption application must be filed annually before June 30th. To qualify for an exemption from the Measure C Marin Wildfire Prevention Authority parcel tax homeowners must meet the following criteria. Taxes and assessments section provides detailed information on new tax information exemptions and exclusions that are available and information on how to have your home or property reassessed.

2022 California Property Tax Rules To Know

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Marin Residents Have Until Monday To Pay Property Taxes

Property Tax Re Assessment Bubbleinfo Com

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

First Installment Of Property Taxes Due Dec 10 In Marin County San Rafael Ca Patch

Understanding California S Property Taxes

California Public Records Public Records California Public

Understanding California S Property Taxes

What Is A Homestead Exemption California Property Taxes

Understanding California S Property Taxes

New Form Released For Surviving Spouse Lod Homestead Property Tax Exemption Contact Your Support Coordinator With Q Property Tax Supportive Homestead Property

Sc Johnson S Administration Building Research Tower Exempt From Property Taxes Frank Lloyd Wright Homes Frank Lloyd Wright Architecture Building

Property Tax Bills On Their Way

California Property Taxes Viva Escrow 626 584 9999

Service Connected Disability Property Tax Exemption Form Contact Your Support Coordinator With Questions Supportive Property Tax Homestead Property

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center