idaho state income tax capital gains

Idaho Capital Gains Tax Rate 2021 with Ingredients and Nutrition Info cooking tips and meal ideas from top chefs around the world. Taxes capital gains as income and the rate is a flat rate of 323.

Idaho State Taxes 2021 Income And Sales Tax Rates Bankrate

Idaho Capital Gains Tax.

. The sales tax rate in Idaho is currently 6. We last updated Idaho FORM CG in January 2022 from the Idaho State Tax Commission. The IRS will start accepting.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income. Includes short and long-term Federal and.

County tax rates range throughout the state. IDAPA 35 IDAHO STATE TAX COMMISSION Tax Policy Taxpayer Resources Unit 350101 Income Tax Administrative Rules. You must complete Form CGto compute your Idaho capital gains deduction.

Tax laws are complex and change regularly. 1 If an individual taxpayer reports capital gain net income in determining Idaho taxable income eighty percent 80 in taxable year 2001 and sixty percent 60 in taxable years thereafter. 63-3035b joint power authorization.

Taxes capital gains as income and the rate is a flat rate of 495. The proposal was outlined in Littles State of the State address and draws from this years 19 billion surplus. One important thing to know about Idaho income taxes.

IDAHO CAPITAL GAINS DEDUCTION -- QUALIFIED PROPERTY 06-24-2015 This information is for general guidance only. Capital gains are taxed as regular income in Idaho and subject to. Capital gains tax in ID applies to any property or asset such as your home that you own for at least one calendar year and sell for more than the cost.

There are -904 days left until Tax Day on April 16th 2020. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. We cant cover every.

A homeowner with a property in. Of the capital gain net income included in federal taxable income from the sale of Idaho property. Section 63-3039 Idaho Code Rules and.

State withholding tax on percentage basis withholding collection and payment of tax. This form is for income earned in tax year 2021 with tax returns due in April 2022. The corporate tax rate is now 6.

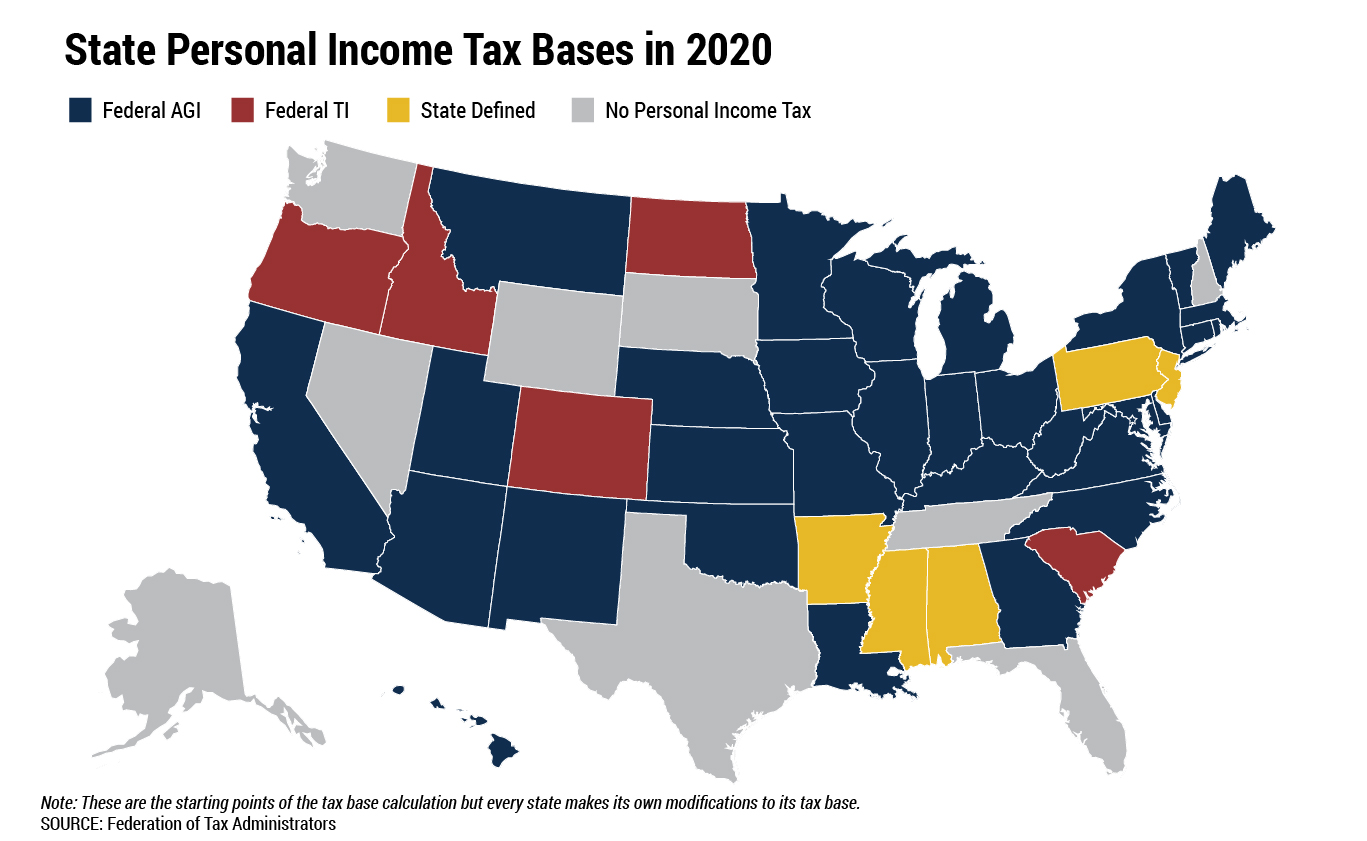

While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income. If you are late paying your Idaho income tax you may be liable to pay interest of up to 4 per year. The entire gain from qualified property of twenty thousand dollars 20000 is eligible for the Idaho capital gains deduction.

These would just be taxed as normal income. To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801. Combined Rate 3193 Additional State Capital Gains Tax Information for Idaho The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent.

Capital gain net income is the amount left over when you reduce your gains. The package includes 350 million for a one-time expenditure. Idaho does not have a special tax rate for gains and losses on stocks bonds or other intangibles.

The capital gains deduction is sixty percent 60. Individual Income Tax Rate Schedule taxidahogovindrate For years. Capital Gains Taxes Capital gains are.

Capital Gains - Idaho State Tax Commission. If you found this answer helpful please press the. 63-3035a state income tax withholding tax on lottery winnings.

Idaho has reduced its income tax rates. For individual income tax the rates range from 1 to 6 and the number of brackets have. Capital gains are taxed as.

Idaho State Tax Quick Facts. In Idaho the uppermost. 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012.

Idaho State Tax Commission. Property Taxes and Property Tax Rates Property Tax Rates In Idaho property taxes are set at the county level.

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Capital Gains Tax Idaho Can You Avoid It Selling A Home

State Taxes On Capital Gains Center On Budget And Policy Priorities

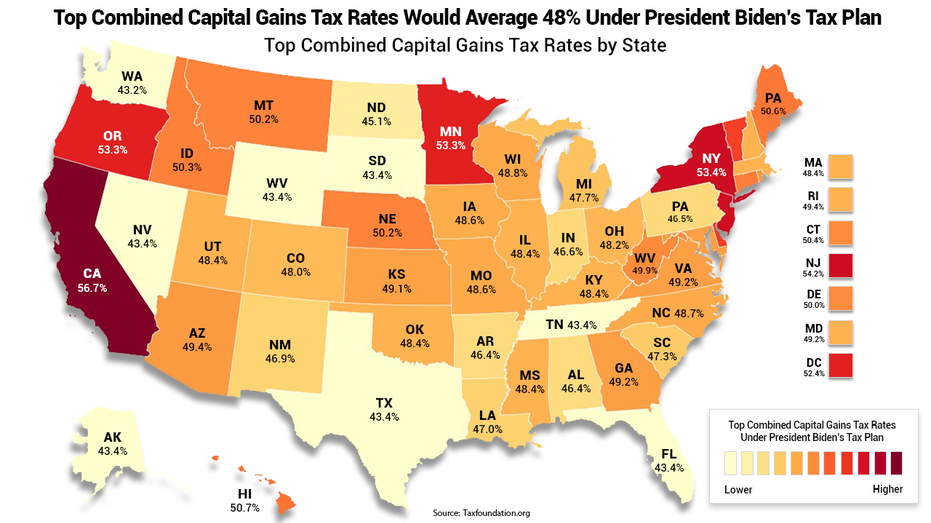

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

State Taxation As It Applies To 1031 Exchanges

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Capital Gains Tax Passes House Heads To Senate For Concurrence Washington State Wire

Gov Inslee Proposes Taxes On Capital Gains Health Insurers Heraldnet Com

Idaho Tax Forms And Instructions For 2021 Form 40

Individual Income Taxes Urban Institute

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Reforming Federal Capital Gains Taxes Would Benefit States Too Itep

Idaho Doesn T Review Its Tax Exemptions Billions Go Uncollected Annually Report Says Idaho Capital Sun

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

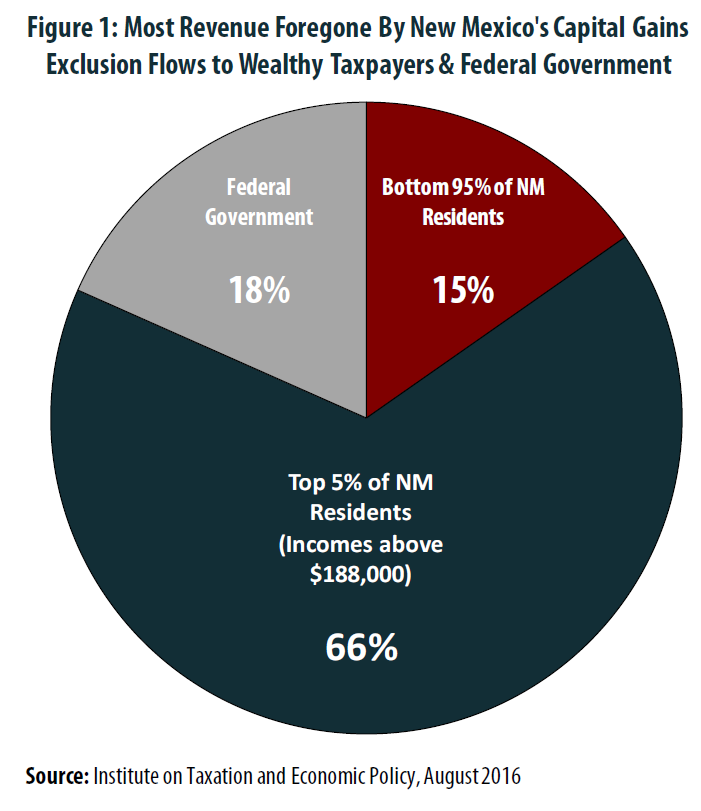

The Folly Of State Capital Gains Tax Cuts Itep

Idaho Income Tax Calculator Smartasset

State Taxes On Capital Gains Center On Budget And Policy Priorities